A brand new fintech start-up, Leap, has launched within the UAE to show youngsters and youngsters tips on how to make higher cash decisions. The Dubai-based start-up is on a mission to spice up youth monetary literacy and cash administration expertise, concentrating on the unbanked under-18 inhabitants. The app is at the moment accessible for youngsters between the ages of 6 and 18 within the UAE, with plans to broaden to Saudi Arabia and Egypt.

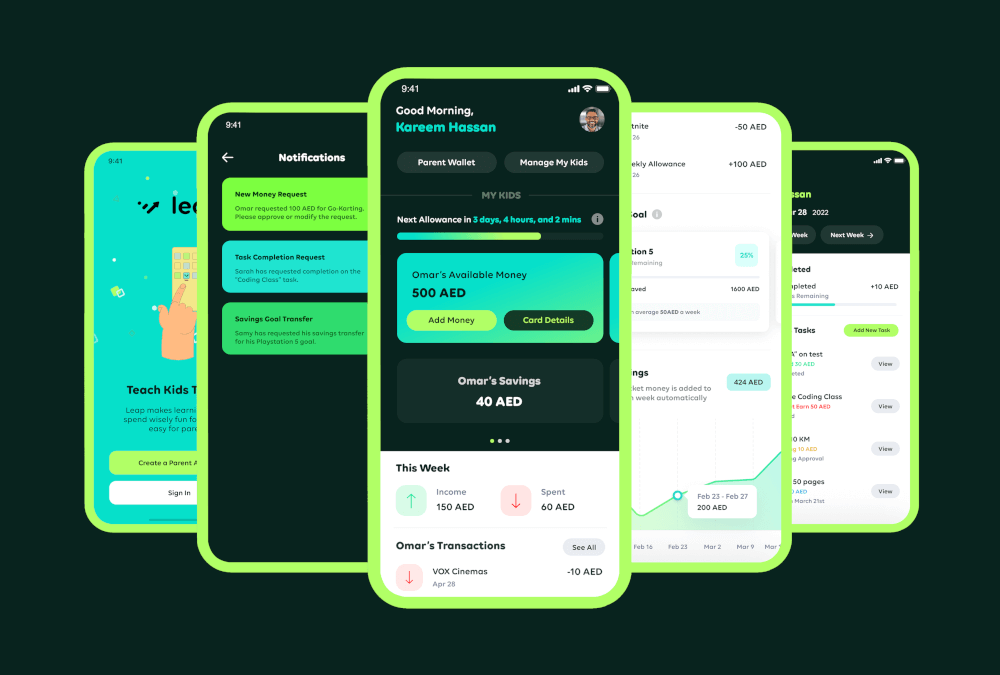

The Leap app is constructed from the bottom up for folks and youngsters and is designed to encourage clear, enjoyable and fascinating cash administration training. The app highlights the significance of youth monetary literacy by encouraging accountable spending and saving habits – nurturing the subsequent era’s potential to be financially accountable and contribute meaningfully to the financial system.

Ziad Toqan, CEO and co-founder of Leap stated: “Monetary literacy is a fundamental life ability, and surprisingly, it is one thing that is not simply realized whereas rising up. Most youngsters get their first style of monetary accountability once they go to varsity with out the supervision and data of tips on how to handle their cash. However it would not should be that method.”

“At Leap, we got down to change that actuality and empower youngsters as younger as 6 to know, worth and handle their cash. We’re extremely excited to launch our app and supply a platform for youths to actually learn to earn, save and spend cash responsibly, all whereas setting themselves up for a profitable future.”

The Leap app is now accessible within the Apple and Android app shops with a 90-day trial interval.

Alain Meier, former CEO of Cognito (now a part of Plaid) stated: “There’s a large alternative within the Center East for accessible monetary training instruments that educate youngsters tips on how to earn, save and spend their cash. Leap’s mission to resolve this downside has the potential to higher equip the subsequent era and assist them obtain higher monetary outcomes. I’m excited to spend money on Leap. Ziad and Jamil have a robust imaginative and prescient of tips on how to tackle this very actual downside within the area.”

After signing up, mother and father and youngsters can log into the app for 2 separate experiences. Mother and father can immediately switch pocket cash to their youngsters, monitor their kid’s spending habits and set duties to finish.

Individually, youngsters will obtain a pay as you go Visa card that’s linked to their Leap account. Within the app, children can set a financial savings aim, analyze their spending habits, and earn rewards for finishing weekly duties set by their mother and father.

The app additionally features a ‘Financial savings on Autopilot’ characteristic which mechanically transfers any unspent cash on the finish of the week – inserting it immediately into the youngsters’s financial savings account. This characteristic will encourage children to spend much less in the course of the week and attain their financial savings aim quicker.

Jamil Khammu, COO and co-founder of Leap stated: “In right now’s world, it is exhausting to maintain children engaged. That is why whereas constructing Leap, it was vital to us to make the expertise each instructional and enjoyable. We made it very straightforward for the youngsters to study, with the mandatory parental supervision to assist information them alongside the way in which.”

The startup additionally has plans to regularly introduce new options that may additional enhance children’ monetary administration expertise, together with extra distinctive methods to encourage financial savings. The aim of the app is to cowl all elements of cash administration to actually educate children tips on how to make their cash develop.

For extra details about Leap, go to: http://savewithleap.com/

To obtain the app, go to:

Apple: http://hyperlink.savewithleap.com/JjYQ3b

Android: http://hyperlink.savewithleap.com/wKE3XO