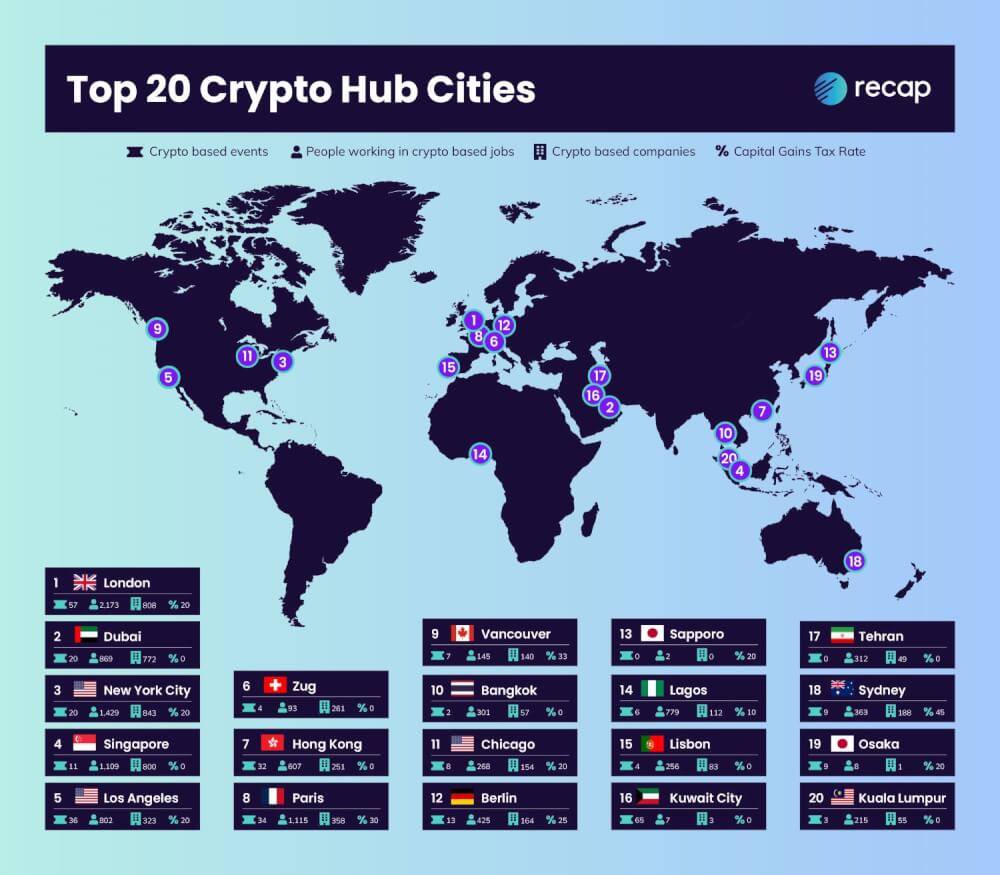

The Metropolis of Gold was ranked second globally within the crypto-ready index by crypto-tax software program startup Recap, simply behind London.

The index contains eight standards, together with the variety of crypto staff and corporations, crypto courting, high quality of life rating, and R&D spending as a proportion of GDP, in every metropolis.

With 0% taxes, Dubai is a horny place to reside for crypto buyers and provides a top quality of life for residents and expats with a rating of 175.84 – seventh highest total. Town’s thriving crypto scene has attracted 772 crypto-based corporations for residents to select from with regards to discovering a profession within the sector, with 869 presently in crypto-related jobs.

After a yr of a number of new legal guidelines for crypto exchanges to function within the metropolis, Dubai is pushing to turn out to be the main middle for cryptocurrencies and blockchain know-how within the Center East.

Regardless of Dubai’s efforts, London has taken the highest spot because the world’s principal crypto hub. In addition to having the best variety of folks working within the crypto trade in comparison with anyplace else, London hosted the second highest variety of crypto-related occasions and conferences all year long and is house to over 800 crypto-based corporations .

New York and Singapore additionally appear like a pressure to be reckoned with with regards to crypto-preparation, rating third and fourth respectively.

Prime 10 crypto-hubs on this planet:

- London, England

- Dubai, UAE

- New York, USA

- Singapore

- Los Angeles, USA

- Zug, Switzerland

- Hong Kong

- Paris, France

- Vancouver, Canada

- Bangkok, Thailand

Daniel Howitt, co-founder and CEO at Recap, commented on the analysis:

“Crypto belongings have grown massively lately and have gotten more and more interconnected with regulated monetary markets, and the truth that so many cities are adopting it’s a optimistic signal. Dubai being the second largest crypto hub on this planet is nice information for the federal government, which plans to launch its personal digital foreign money by 2026.”

“On the identical time, our analysis reveals that the least developed nations on this planet are a lot much less able to turn out to be crypto-hubs. The dearth of infrastructure, international funding and expert labor within the space might clarify why some are left behind. This might create limitations to buying and selling with extra developed crypto-hubs sooner or later – so it is essential to offer everybody the chance to stand up to hurry.”

“Whereas Dubai excels in attracting crypto corporations and jobs as a tax haven, the town lags behind by way of crypto occasion choices and R&D spending. Extra funding in these areas might advance its place as a worldwide crypto-hub.”

He added: “The UAE has spent quite a lot of time positioning itself as a crypto hub, making a play on attracting entrepreneurs and startups to arrange store. This might be only the start for Dubai – will probably be fascinating to see how crypto grows over the subsequent yr and whether or not or not Dubai can come out on prime.”

The total report may be discovered right here: https://recap.io/weblog/the-rise-of-crypto-hubs-which-cities-are-leading-the-way-in-cryptocurrency